Many of us suffer from home country bias which pushes us towards investing mostly in the stock market of our resident country. Is this a good thing for our portfolios? I suppose it depends, ex post, it may seem like a good thing if you happened to be born in a country that had high returns. However, what if you were born in Japan in 1970, and started investing in the Japanese stock market in 1990 and attempted to retire in 2022? Japan’s stock market returned a paltry 2.17% annualized during this time period, so it would have certainly helped to diversify. The issue with not investing in foreign markets, coming from a US based investor, is that we don’t know ahead of time which countries are going to be the winners. Argentina and Peru, for example both have markets that collapsed many times leaving participants with zero or close to it. It may seem obvious in hindsight, that the US was a good investment over the past 40 or so years but it is not as easy a call to make in the moment. All data in this study is taken from Ken French’s website.(http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/index.html)

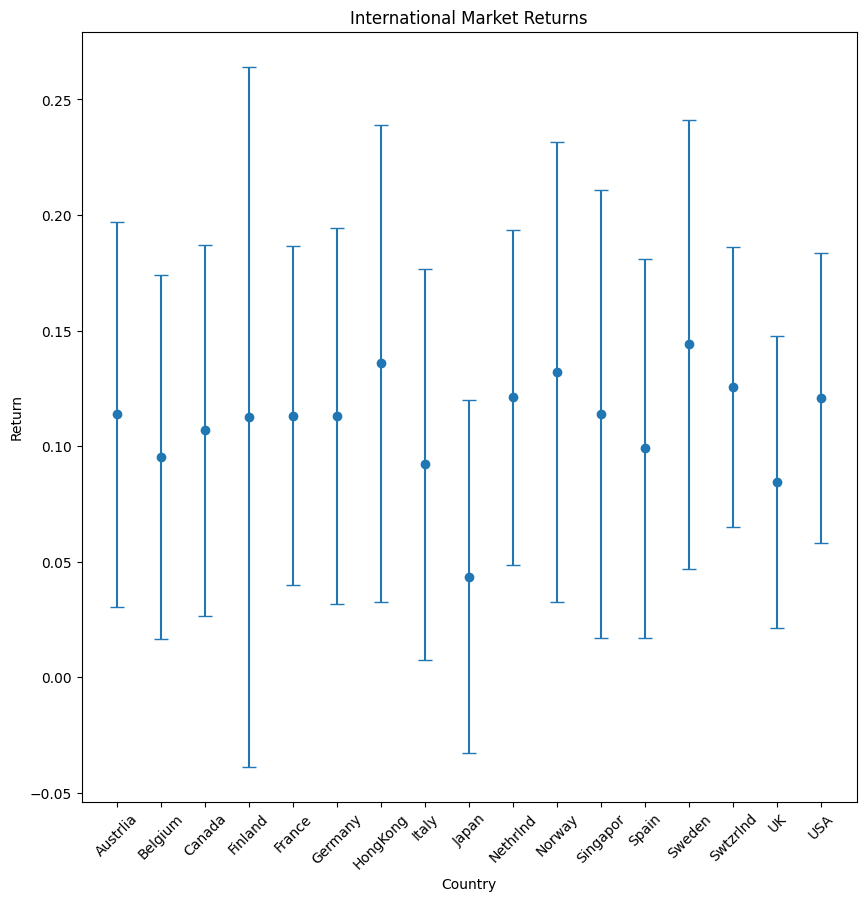

The chart above shows annual stock market returns for developed market equities from 1988 through 2022 in USD. The error bars show the 95% Confidence Interval of the true population mean annual return for each country. The takeaway from this chart? Virtually every one of these bars is overlapping! So what assumptions can we make on a go forward basis when thinking about investing over the next 30 or so years? Equal returns on average is a pretty good assumption, in which case, our objective function should be to minimize variance.

A common criticism is that markets are becoming more globalized and therefore correlations are increasing reducing the benefits of diversification. While this is a fair criticism, there are still benefits to be had from diversifying across different countries markets. Diversification is the one area where the age old saying “there is no free lunch” does not hold.

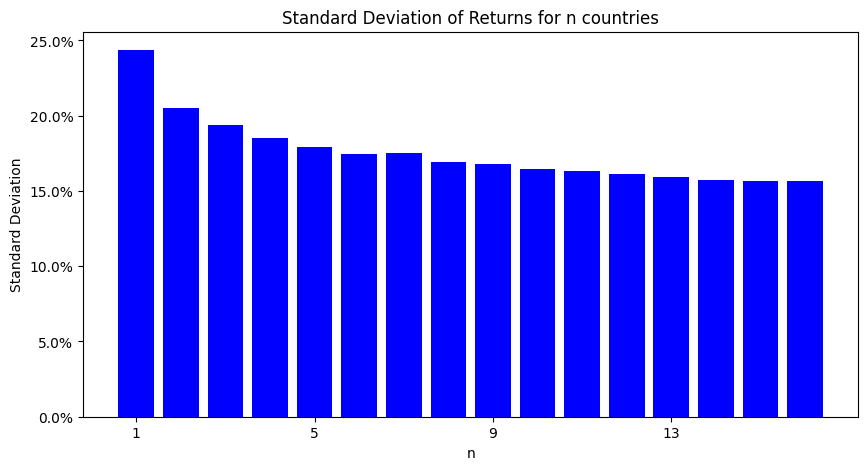

In the chart above I plotted the minimum variance portfolios for n developed markets using returns from 1988 – 2022. For example, for n = 4 there are 4 different countries in this portfolio and the minimum variance is approximately 19%. The countries are randomly sampled without replacement 100 times and the average is reported. As we can see, even in this age of globalization, the diversification benefits of adding international exposure are alive and well as the minimum variance portfolio goes from ~25% down to ~16% as we add more countries. This same result holds with equal weighted portfolios, although less substantially.

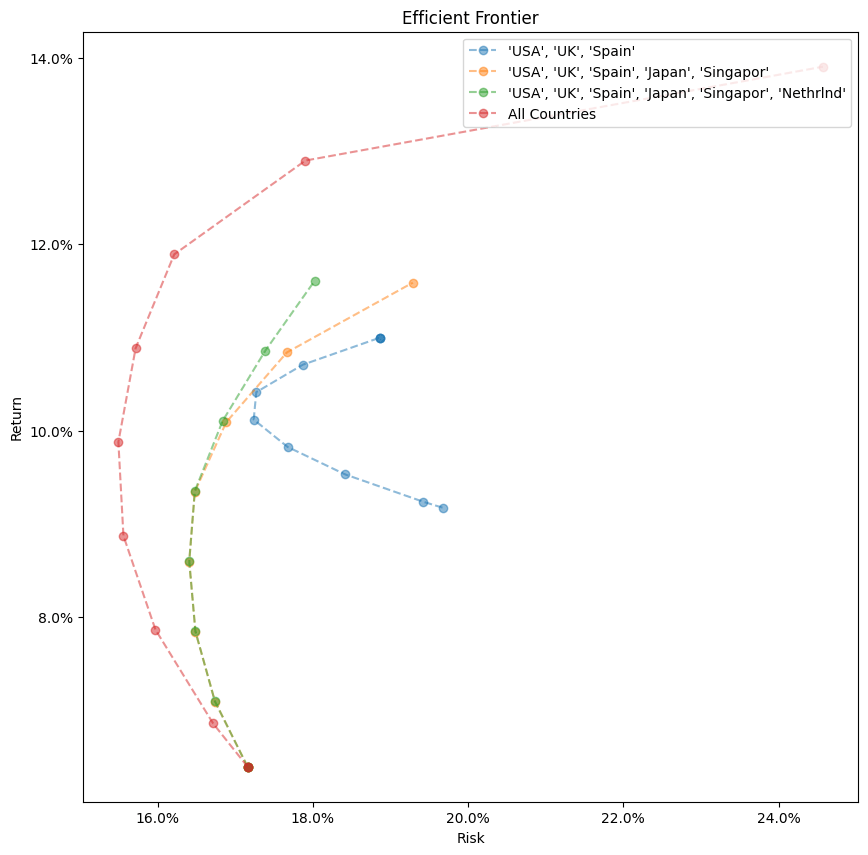

In the chart above I plot the efficient frontiers for various subsets of developed market portfolios from 1988 through 2022. Here, as we saw in the previous chart with respect to the minimum variance portfolios, the frontier consistently is bowing outwards as the opportunity set grows. In other words, the effects of diversification are allowing for better or equal returns with lower risk, ergo, international diversification is in fact a positive, at least with respect to the countries in this small example.

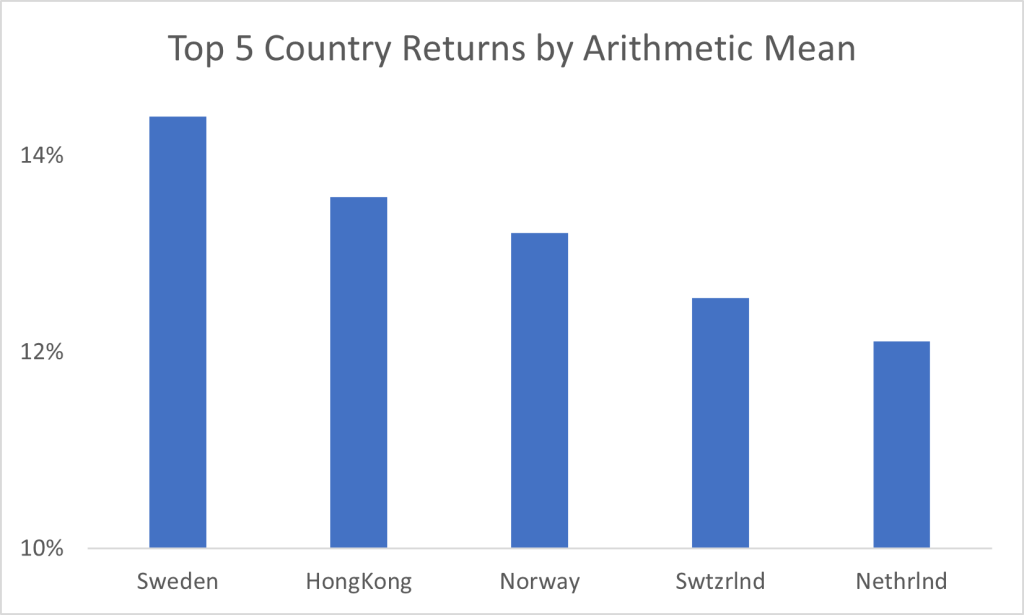

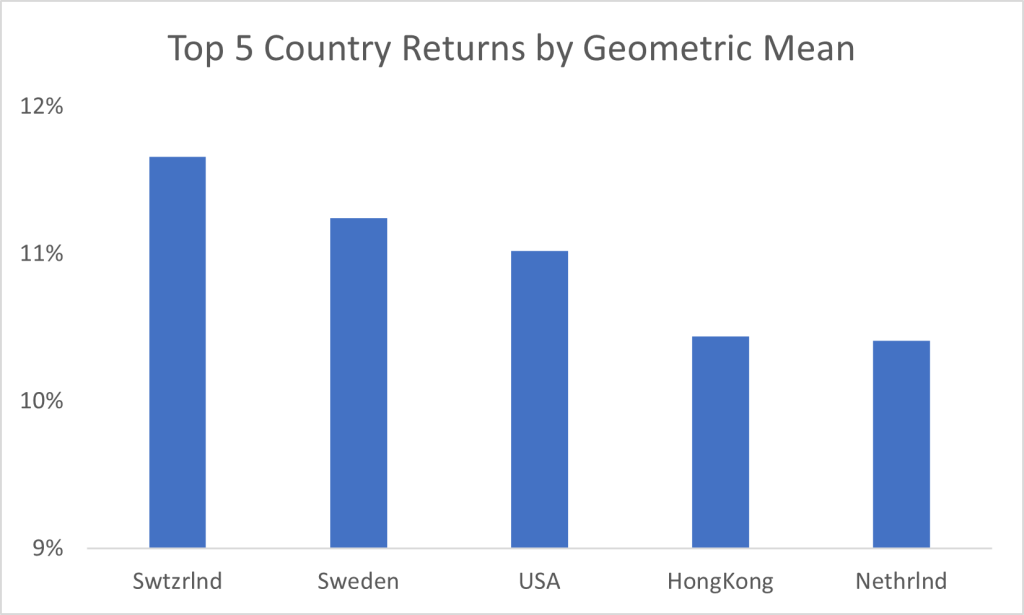

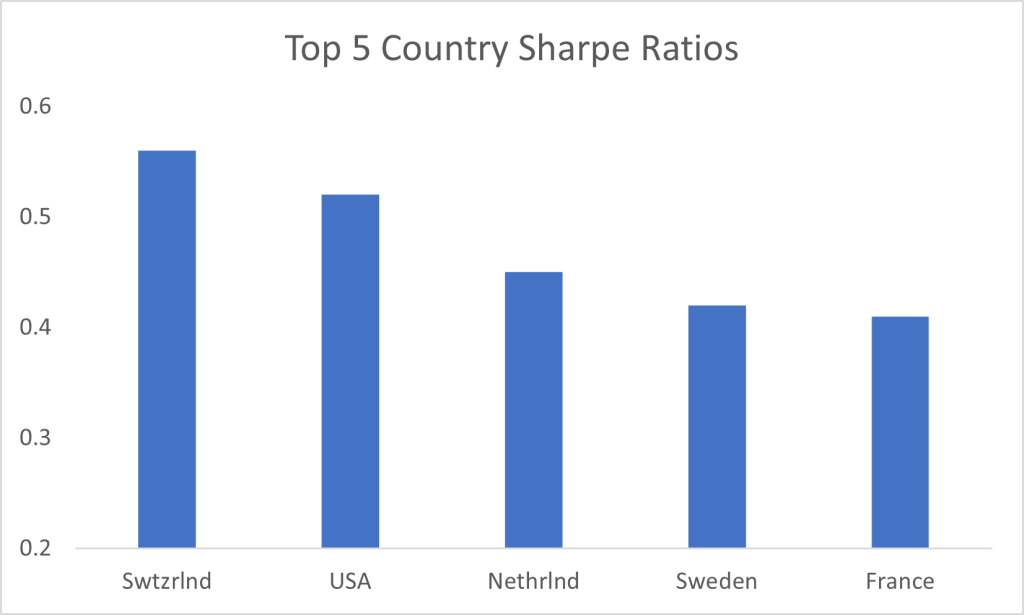

So what happened during this time frame, who are the winners and losers? In the gallery below I have have charted the top 5 annual arithmetic mean returns, geometric mean returns, and sharpe ratios of countries from the period 1988 – 2022. As it turns out, Switzerland actually had a better return and sharpe ratio during this period than the US, actually US came in third behind Switzerland and Sweden in terms of Geometric return. In 1988 would this have been an obvious bet? I don’t think so, or how about the average return of Hong Kong beating the average return of the US? The point is, that in hindsight, it may seem obvious that one country outperformed others, but it is much different to make that call in real time.

Conclusions:

- Mean returns for developed countries are not vastly different from one another on a medium / longish term horizon (~30 years).

- Since we can’t pick winners ahead of time, it is best to minimize variance.

- Diversifying internationally reduces portfolio Standard Deviation.

Leave a comment