A common opinion held in the crypto enthusiast community, is that Bitcoin acts as an inherent “hedge” against inflation. I often hear the argument that because Bitcoin has a finite supply it has a natural hedge against inflation. It is my position that although on the surface it makes logical sense, in practice that is not the case.

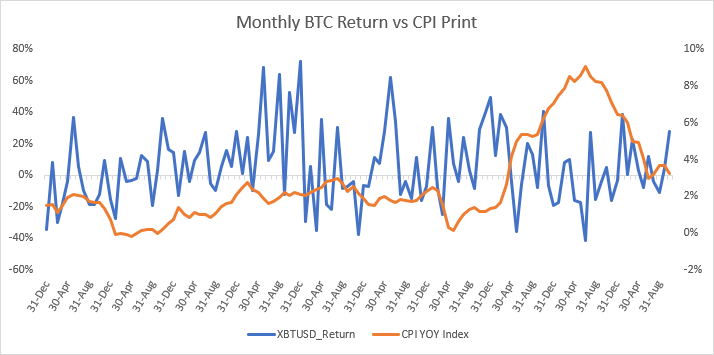

Examining the table above shows the monthly returns of Bitcoin plotted against the monthly CPI print. In order for Bitcoin to be a proper hedge against inflation we would expect there to be a high degree of co-movement between inflation and the returns on Bitcoin. When inflation increases we would expect returns on Bitcoin to increase thus acting as a hedge. In looking at the chart, it is hard to really see the correlation but it certainly looks like at least in the latter part of the chart (2021 – 2023) this is certainly not the case as the orange line is increasing and the returns on BTC vary wildly and are mostly negative. This was the period where Bitcoin dropped from a high of ~ $60k to less than $20k, precisely when inflation was at it’s highest and the “hedginess” of the position was most needed.

To quantify this statistically we can run an OLS Regression on the two variables, using Bitcoin returns as the dependent variable and CPI as the independent variable. Below are the results of that analysis.

| Coefficient | t-stat | |

| CPI | -2.46 | -1.81 |

| Intercept | 12.21 | 2.81 |

| R^2 | .03 | |

| F-statistic | 3.26 |

In fact, the regression coefficient of CPI is negative 2.46, meaning for every 1% increase in the CPI print, Bitcoin actually returns -2.46%, which is the wrong direction for a hedge. However, my contention is that Bitcoin actually responds more to a “risk on” appetite in the markets and generally behaves like a technology stock. In order to test this hypothesis I added the monthly returns to the NASDAQ index to this regression. Below are the results of that analysis.

| Coefficient | t-stat | |

| CPI | -1.81 | -1.36 |

| NASDAQ | 1.23 | 3.16 |

| Intercept | 8.76 | 2.03 |

| Adjusted R^2 | .09 | |

| F-statistic | 6.73 |

It turns out, the returns on the NASDAQ are both positive and statistically significant, and when added to the OLS regression not only does the adjusted R^2 and the F-statistic increase, but also the statistical significance of the CPI variable decreases. This supports the argument that Bitcoin behaves more like a technology stock than an actual inflation hedge, as is my contention.

To summarize:

- Contrary to popular belief, Bitcoin does not behave as a hedge for inflation.

- Bitcoin behaves much more like a technology stock than an appropriate inflation hedge.

Leave a comment